Hong Kong officials hope to experience temporary buffer

naky

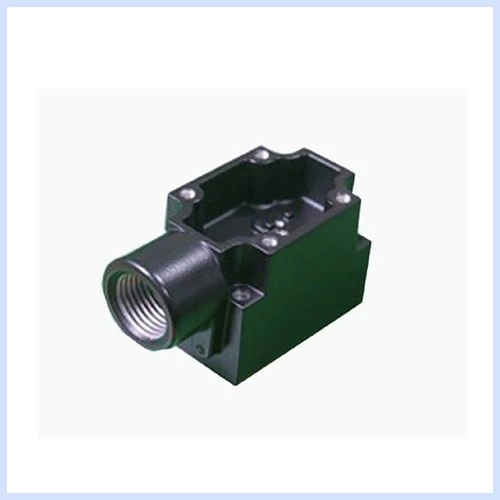

www.diecastingpartsupplier.com

2015-12-18 10:49:33

There is an irony to the fact Hong Kong’s economy may enjoy a temporary cushion from the effects of rising US interest rates because of China’s bungled summer renminbi devaluation.

The territory, with its currency pegged to the dollar and its future tied to China, is trapped between the conflicting forces of tighter US policy and the slowdown in the mainland.

Its economy is slowing, yet yesterday, the peg obliged the Hong Kong Monetary Authority, worried about a surge in outflows to the US, to match the Federal Reserve’s quarter-point rate rise.

Last week Norman Chan, HKMA chief executive, was blunt about his worries when he told a gathering of economists in the city to be prepared for a “period of capital outflows, rising interest rates and slower growth”.

Frederic Neumann, co-head of Asian economic research at HSBC, said the slowdown was inevitable. “We had the best of all worlds for years; we had very low US rates and a boom in China,” he said. “Now China is slowing and the Fed is raising rates, so we get a double whammy for Hong Kong.”

Property prices are already feeling the pressure, slipping 6 per cent in the past three months and forcing developers to offer ever greater sweeteners to help maintain prices.

But debt has soared, with private sector borrowing at 200 per cent of gross domestic product, according to UBS.

“This isn’t going to be like 2004,” said Duncan Wooldridge, economist at UBS. “The US rate cycle, China’s business cycle and [weakening] Chinese renminbi are not favourable for Hong Kong.”

The city’s economy may still receive a temporary reprieve if bank rates are slow to rise, which looks likely after China’s shock devaluation in August triggered a rush to switch renminbi for Hong Kong dollars.

That pushed excess liquidity, in the form of aggregate bank balances, to HK$426bn, the highest since 1997. Analysts at ANZ Bank estimate liquidity, now HK$391bn, would have to fall to $285bn before local banks need to raise rates to attract funds.