How to find China’s elusive consumption boom

naky

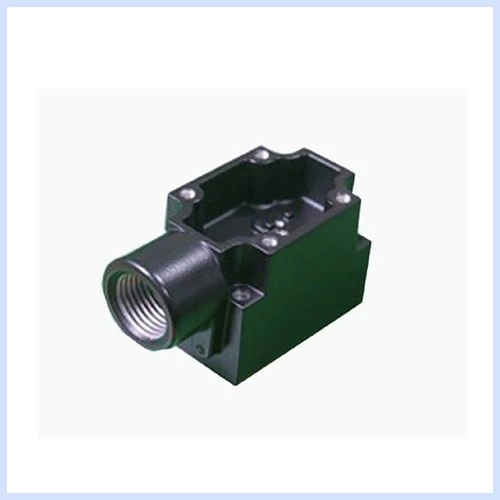

www.diecastingpartsupplier.com

2016-08-31 17:16:09

As anyone who reads these pages knows, China’s growth has slowed and its economy is, little by little, rebalancing away from investment and towards consumption. Yet many are also left scratching their heads by news that sales of a wide range of consumer products, from luxury cars to cheap local beer, are so sluggish. If consumption is so strong, why can’t we see it? The answer is simple: people are looking in the wrong places. Both high-end and low-end retail are faring poorly. But look at the middle tier, and the story could scarcely be more different. This is where the consumption boom is unfolding.

Start with the luxury segment. Its best days could well be over. Luxury consumption is slowing, weighed down by a decelerating economy, the ongoing crackdown on corruption and the ‘commodification’ of luxury goods — that is, the idea that Chinese buyers no longer see them as so special or unique. China’s luxury spending contracted for the very first time in 2014. This was just the tipping point. In 2015, Swiss watch exports to Hong Kong, a bellwether of Chinese luxury buying, fell 23 per cent. The sales of Rolls-Royce cars tumbled 54 per cent in China that same year.

At the low end of the market, the drivers are different but the outlook is equally bleak. The race-to-the-bottom approach of cheap Chinese brands, a winning formula in the past, has run its course. Rising income levels have led consumers to focus more on questions of quality and health, for which they are now able and willing to pay. As a result, fast-moving consumer goods companies targeting blue-collar consumers are losing out. Sales volumes of instant noodles and beer (which is often cheaper than mineral water in China) fell 12.5 per cent and 3.6 per cent last year, respectively. The ecommerce space is also experiencing a tectonic shift, from consumer-to-consumer platforms for cheap unbranded goods to business-to-consumer alternatives for branded quality products. Transaction volumes on the latter rose from 25 per cent of the total ecommerce market in 2011 to 51 per cent in 2015.

Amid all this upheaval at the high and low end of the market, the sweet spot is right in the middle. This value-for-money segment, which strives to balance quality and price, is already the fastest-growing consumer segment in China. As China’s middle class expands (McKinsey predicts it will increase from 174m households in 2012 to 271m by 2022), this middle retail segment will grow in lockstep with it.

Consider a few examples of the consumer brands already profiting handsomely from this trend. Korean cosmetics brands with their “cheap chic”, offering design and marketing similar to European high-end brands but with affordable prices and more of an Asian style, are immensely popular in China, particularly among the younger generation. The front runner is Amorepacific, which owns brands including Innisfree, Laneige and Etude. It has quadrupled its stock price since 2014 on the back of strong China sales. Global fast fashion houses are also having a big run. Uniqlo, the Japanese clothing company, delivered a gob-smacking 62 per cent annualised sales growth in China from 2013 to 2015. Decathlon, a French sports supplies retailer, grew its store network in China from 55 in 2012 to 166 in 2015, capitalising on the value-for-money trend.

Flashy Swiss watches are losing their grip on wealthy Chinese wrists. And ordinary Chinese are losing their taste for instant noodles. Consumption is instead converging on the middle, in terms of both product preference and customer base. This is a good thing for the economy, a reflection of a more balanced growth model and a more equal distribution of wealth. For consumer brands, both international and local, the challenge is to win the hearts of China’s rising middle class. They are educated and well informed, and they want to spend money on quality products, so long as the price is fair.