Customers might have to pay tax on goods and services bought online

Angelia

www.diecastingpartsupplier.com

2017-11-20 18:49:17

Goods and services tax (GST) could soon be levied on e-commerce purchases as the Government looks to diversify its tax base and capture value from this fast-growing sector, experts said.

This could mean getting big e-commerce players to register for GST here if they sell to Singapore consumers, or getting the customers themselves to pay tax on the goods and services they buy online.

Their comments come after Senior Minister of State for Law and Finance Indranee Rajah said in an interview with Bloomberg on Tuesday (Nov 21) that e-commerce will likely come under the local tax regime soon.

"You can imagine, 20 years from now, the way people purchase is very different and by that time online platforms will be mainstays, so if that’s not part of the tax regime, there’s going to be a lot of holes there," she said.

Finance Minister Heng Swee Keat said in the Budget earlier this year too that the Government was studying ways to tax e-commerce.

Currently, online purchases of goods and services under $400 are not taxed in Singapore. "The $400 GST exemption threshold could be reviewed for the purposes of capturing online shopping transactions," said KPMG Singapore’s head of tax, Mr Chiu Wu Hong.

"Digital services (eg music downloads, e-books) rendered by foreign companies could be brought into the GST net by using a ’reverse charge’ mechanism, or by way of requiring them to register for GST if they were to provide to end consumers in Singapore."

A reverse charge mechanism requires the customer to account for the tax on supplies received from foreign suppliers.

PwC Singapore’s Asia Pacific indirect tax leader Koh Soo How noted too that the Government has said that the main intention of bringing online shopping within the tax regime is to make it a level playing field between local GST-registered retailers and overseas sellers.

"There are different collection models for imposing the GST on cross-border transactions. However, what most countries have settled on when taxing the digital economy is the vendor collection model which is seen to be most feasible in terms of practicality and costs," he said.

Under such a model, the overseas vendor is required to register for GST to collect and account for GST on sales to consumers in the local country.

Mr Yeo Kai Eng, a GST services partner at Ernst & Young Solutions, noted that this has been a common approach in several countries, which have also introduced simplified GST registration for overseas suppliers of digital services and low-value goods to make it less onerous on the e-commerce players.

"The key for Singapore is not to rush into it," he said. "Consultation with key stakeholders should be made to study the impact and effectiveness of any new measures to impose GST on overseas suppliers of digital services and low-value goods before they are introduced."

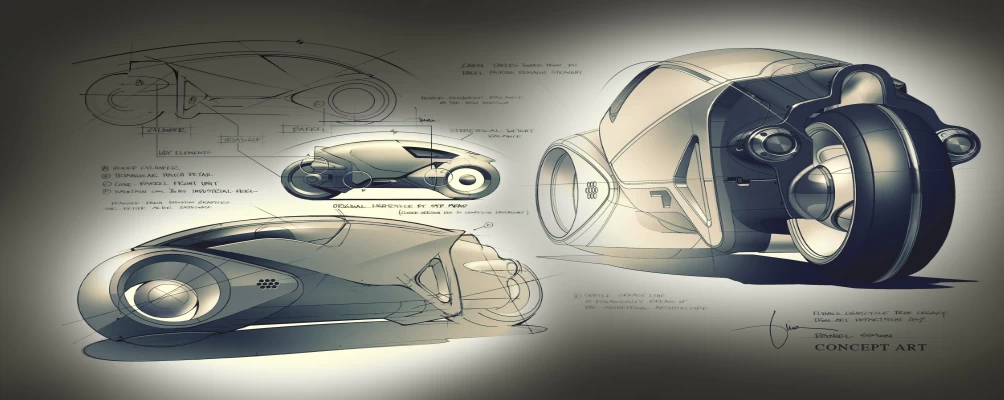

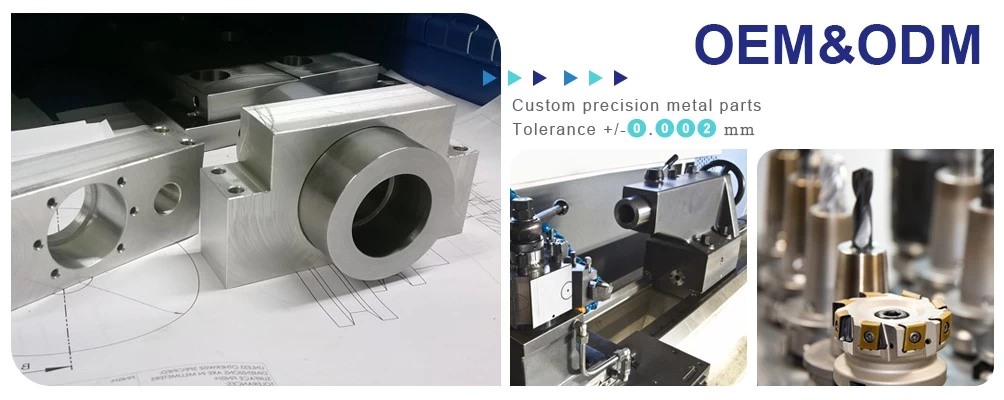

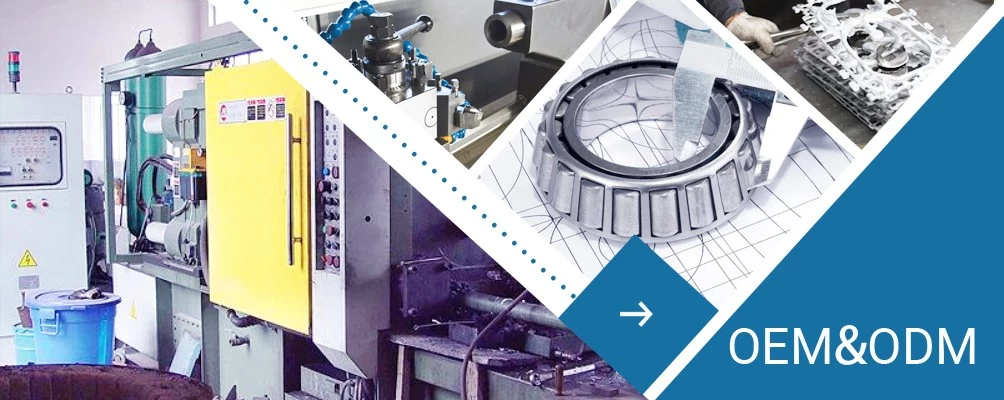

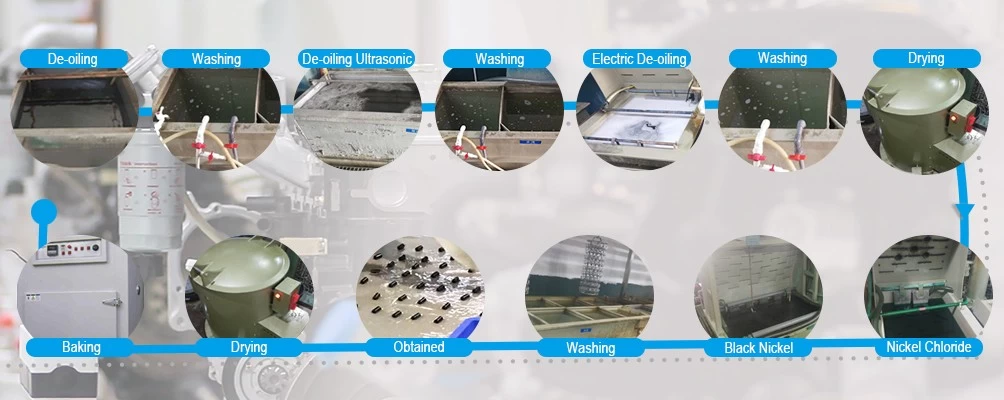

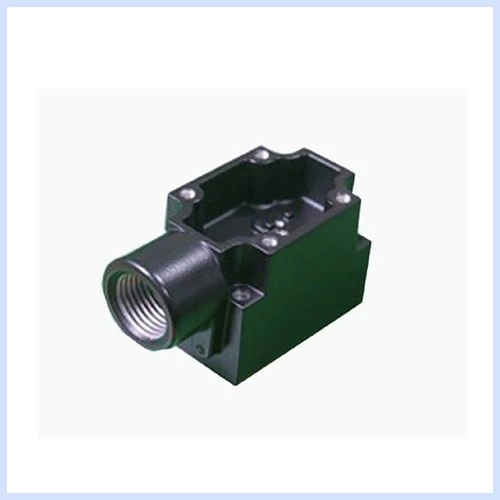

XY-GLOBAL is the most professional car spare parts,car spare parts accessories ,car parts,We have ISO90001 and TS16949 quality system,Our major customers are Flextronics,HP over 7 years

This could mean getting big e-commerce players to register for GST here if they sell to Singapore consumers, or getting the customers themselves to pay tax on the goods and services they buy online.

Their comments come after Senior Minister of State for Law and Finance Indranee Rajah said in an interview with Bloomberg on Tuesday (Nov 21) that e-commerce will likely come under the local tax regime soon.

"You can imagine, 20 years from now, the way people purchase is very different and by that time online platforms will be mainstays, so if that’s not part of the tax regime, there’s going to be a lot of holes there," she said.

Finance Minister Heng Swee Keat said in the Budget earlier this year too that the Government was studying ways to tax e-commerce.

Currently, online purchases of goods and services under $400 are not taxed in Singapore. "The $400 GST exemption threshold could be reviewed for the purposes of capturing online shopping transactions," said KPMG Singapore’s head of tax, Mr Chiu Wu Hong.

"Digital services (eg music downloads, e-books) rendered by foreign companies could be brought into the GST net by using a ’reverse charge’ mechanism, or by way of requiring them to register for GST if they were to provide to end consumers in Singapore."

A reverse charge mechanism requires the customer to account for the tax on supplies received from foreign suppliers.

PwC Singapore’s Asia Pacific indirect tax leader Koh Soo How noted too that the Government has said that the main intention of bringing online shopping within the tax regime is to make it a level playing field between local GST-registered retailers and overseas sellers.

"There are different collection models for imposing the GST on cross-border transactions. However, what most countries have settled on when taxing the digital economy is the vendor collection model which is seen to be most feasible in terms of practicality and costs," he said.

Under such a model, the overseas vendor is required to register for GST to collect and account for GST on sales to consumers in the local country.

Mr Yeo Kai Eng, a GST services partner at Ernst & Young Solutions, noted that this has been a common approach in several countries, which have also introduced simplified GST registration for overseas suppliers of digital services and low-value goods to make it less onerous on the e-commerce players.

"The key for Singapore is not to rush into it," he said. "Consultation with key stakeholders should be made to study the impact and effectiveness of any new measures to impose GST on overseas suppliers of digital services and low-value goods before they are introduced."

XY-GLOBAL is the most professional car spare parts,car spare parts accessories ,car parts,We have ISO90001 and TS16949 quality system,Our major customers are Flextronics,HP over 7 years