China second-quarter economic growth figures.

Angelia

www.diecastingpartsupplier.com

2016-07-25 14:43:30

HONG KONG — China on Friday reported its second-quarter economic growth figures. The numbers are among the world’s most closely watched because the country has been a major driver of global economic growth. But data from China are notoriously questionable. This is what you should take away from Friday’s results.

China to World: Everything Is O.K.

China’s second-quarter gross domestic product rose 6.7 percent compared with a year ago.

Friday’s figure suggests there’s no reason to panic. China’s economy is slowing but at a reasonable, steady pace well in line with Beijing’s expectations. It also matches the first-quarter number, and still came in at a pace that other countries envy.

Of course, China’s headline G.D.P. figure is one of the country’s least-trusted economic indicators. Li Keqiang, currently China’s premier, once famously described the figure as “man-made.” Some economists argue that the real rate of expansion is substantially lower than the reported figure.

Looking a bit closer, it’s clear that China’s slowdown is uneven. Some sectors, like mining and manufacturing, are being clobbered. Others, like e-commerce and nontraditional finance, are relative bright spots, while the housing market in some big cities is downright frothy.

China’s Property Market Is Back — for Now

China’s property investment in the first six months of the year rose 6.1 percent from a year ago, compared with 7 percent in the January-to-May period.

That slight slowdown in June offers a reminder that new strength from China’s property sector has been pretty uneven.

To be sure, the rebound in the property market is helping to prop up growth across the country. Roughly one-quarter of China’s economic activity is related to property. Last year a drop in the market hit China’s growth results, as investors worried about an oversupply of unsold homes, especially in smaller cities, and put their money into stocks instead.

Those worries appear to have been swept aside. Land purchases by developers have recovered as builders turn more optimistic. That is also good for local governments, which rely on revenue from land sales to fund a huge portion of their spending. New home sales and construction starts by developers are also rebounding strongly.

The question is how sustainable this property recovery might be. Home prices in rich metropolises like Shenzhen and Shanghai are rising at rates reminiscent of dot-com stocks of another era. If the property market becomes just another Chinese bubble, it may not help offset the sharp slowdown among China’s factories.

Factories Are Still Struggling

China’s June industrial production rose 6.2 percent from a year earlier, compared with 6 percent in May.

Many traditional smokestack industries in China are still struggling, and that is dragging down the broader economy. Despite the slight rise in the June figure, industrial production data indicates that the manufacturing deceleration that China has seen for the last six years shows few signs of bottoming out.

China’s zombie factories — many state owned or state supported — continue to churn out goods that nobody buys. Weak overseas demand is another problem, and exports have continued to contract this year.

There could be some light at the end of the tunnel. Factories would get a big lift if they could regain pricing power. Data on factory pricing shows that deflation appears to be easing at last after four tough years.

But the bigger hope is that consumer demand can replace traditional industry as the main driver of China’s economy.

Are Shoppers Taking a Break?

China’s June retail sales rose 10.6 percent from a year ago.

At first glance, Chinese consumers do appear to be stepping up their game, as June’s figure was an improvement from May’s. But May’s figure was the weakest rate since the 2003 outbreak of SARS, once seasonal distortions like holidays are factored out.

China bulls often point to the blistering pace of expansion of e-commerce as one of the country’s brightest growth spots. Online sales of goods rose 27 percent in the first six months, data released Friday showed. Still, that is down sharply from their growth rate a year ago China bears would argue that online shopping platforms are just cannibalizing sales from traditional department stores.

State Spending to the Rescue

Government investment in fixed assets rose 23.5 percent in the first six months, while growth in private investment slowed to 2.8 percent.

China has seen a dramatic falloff in investment by the private sector, previously China’s biggest engine of investment growth. That could have been hugely destabilizing for employment, wages and the economy as a whole. But the government has stepped in with gusto, ramping up investment by the state.

There are signs that Beijing is getting less bang for its buck, however, as new infrastructure works and other projects fail to generate the same economic returns that they did in years past. What’s more, this investment surge is being bankrolled by an expanding credit binge. New bank lending has been growing gangbusters this year, raising the risk that China will face a painful day of reckoning further down the road.

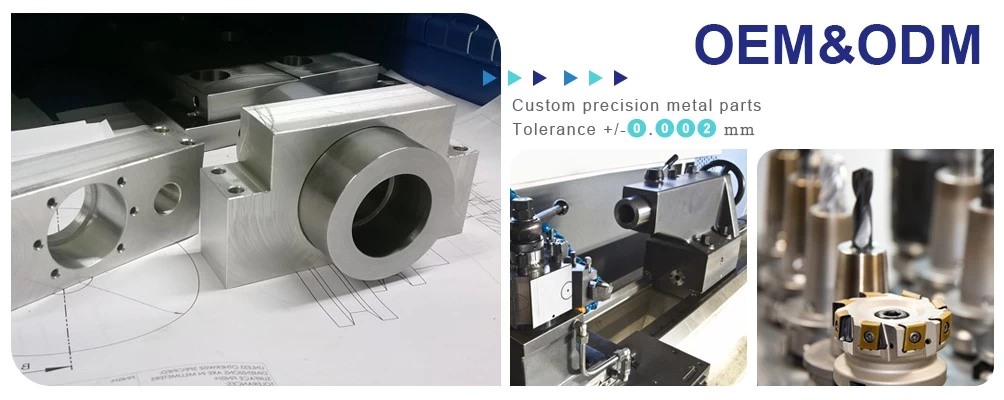

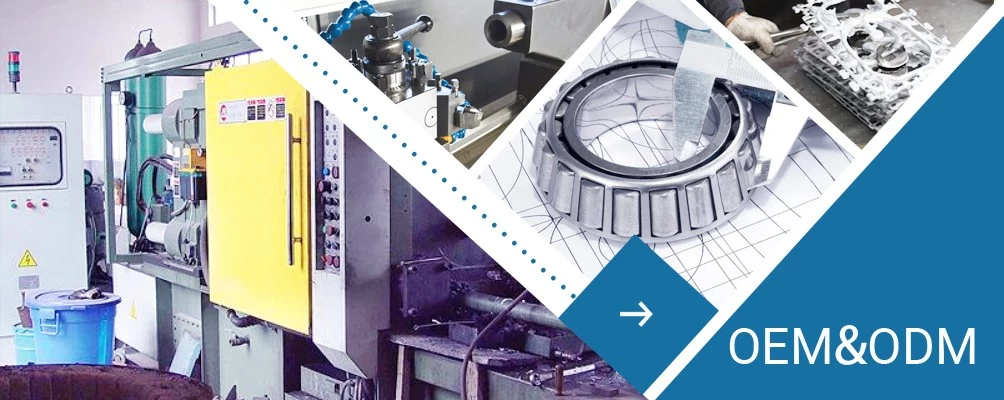

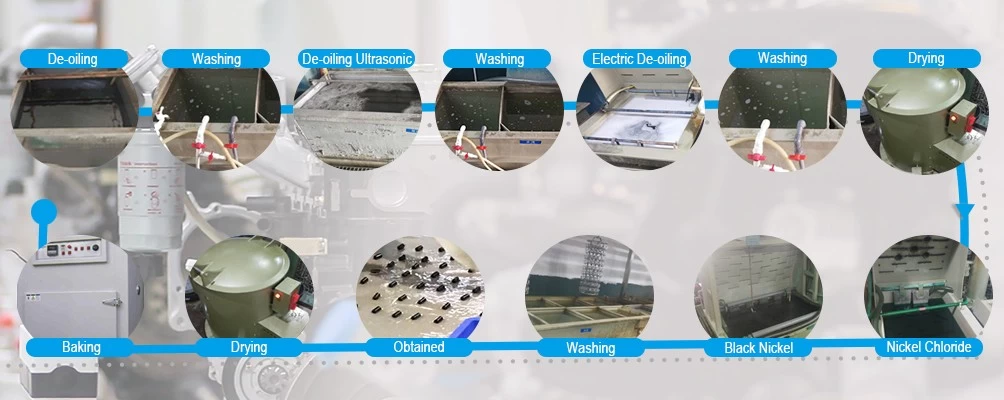

XY-GLOBAL is the most professional aluminum cnc machining service,cnc machining service,aluminum cnc machining parts,We have ISO90001 and TS16949 quality system,Our major customers are Flextronics,HP over 7 years

China to World: Everything Is O.K.

China’s second-quarter gross domestic product rose 6.7 percent compared with a year ago.

Friday’s figure suggests there’s no reason to panic. China’s economy is slowing but at a reasonable, steady pace well in line with Beijing’s expectations. It also matches the first-quarter number, and still came in at a pace that other countries envy.

Of course, China’s headline G.D.P. figure is one of the country’s least-trusted economic indicators. Li Keqiang, currently China’s premier, once famously described the figure as “man-made.” Some economists argue that the real rate of expansion is substantially lower than the reported figure.

Looking a bit closer, it’s clear that China’s slowdown is uneven. Some sectors, like mining and manufacturing, are being clobbered. Others, like e-commerce and nontraditional finance, are relative bright spots, while the housing market in some big cities is downright frothy.

China’s Property Market Is Back — for Now

China’s property investment in the first six months of the year rose 6.1 percent from a year ago, compared with 7 percent in the January-to-May period.

That slight slowdown in June offers a reminder that new strength from China’s property sector has been pretty uneven.

To be sure, the rebound in the property market is helping to prop up growth across the country. Roughly one-quarter of China’s economic activity is related to property. Last year a drop in the market hit China’s growth results, as investors worried about an oversupply of unsold homes, especially in smaller cities, and put their money into stocks instead.

Those worries appear to have been swept aside. Land purchases by developers have recovered as builders turn more optimistic. That is also good for local governments, which rely on revenue from land sales to fund a huge portion of their spending. New home sales and construction starts by developers are also rebounding strongly.

The question is how sustainable this property recovery might be. Home prices in rich metropolises like Shenzhen and Shanghai are rising at rates reminiscent of dot-com stocks of another era. If the property market becomes just another Chinese bubble, it may not help offset the sharp slowdown among China’s factories.

Factories Are Still Struggling

China’s June industrial production rose 6.2 percent from a year earlier, compared with 6 percent in May.

Many traditional smokestack industries in China are still struggling, and that is dragging down the broader economy. Despite the slight rise in the June figure, industrial production data indicates that the manufacturing deceleration that China has seen for the last six years shows few signs of bottoming out.

China’s zombie factories — many state owned or state supported — continue to churn out goods that nobody buys. Weak overseas demand is another problem, and exports have continued to contract this year.

There could be some light at the end of the tunnel. Factories would get a big lift if they could regain pricing power. Data on factory pricing shows that deflation appears to be easing at last after four tough years.

But the bigger hope is that consumer demand can replace traditional industry as the main driver of China’s economy.

Are Shoppers Taking a Break?

China’s June retail sales rose 10.6 percent from a year ago.

At first glance, Chinese consumers do appear to be stepping up their game, as June’s figure was an improvement from May’s. But May’s figure was the weakest rate since the 2003 outbreak of SARS, once seasonal distortions like holidays are factored out.

China bulls often point to the blistering pace of expansion of e-commerce as one of the country’s brightest growth spots. Online sales of goods rose 27 percent in the first six months, data released Friday showed. Still, that is down sharply from their growth rate a year ago China bears would argue that online shopping platforms are just cannibalizing sales from traditional department stores.

State Spending to the Rescue

Government investment in fixed assets rose 23.5 percent in the first six months, while growth in private investment slowed to 2.8 percent.

China has seen a dramatic falloff in investment by the private sector, previously China’s biggest engine of investment growth. That could have been hugely destabilizing for employment, wages and the economy as a whole. But the government has stepped in with gusto, ramping up investment by the state.

There are signs that Beijing is getting less bang for its buck, however, as new infrastructure works and other projects fail to generate the same economic returns that they did in years past. What’s more, this investment surge is being bankrolled by an expanding credit binge. New bank lending has been growing gangbusters this year, raising the risk that China will face a painful day of reckoning further down the road.

XY-GLOBAL is the most professional aluminum cnc machining service,cnc machining service,aluminum cnc machining parts,We have ISO90001 and TS16949 quality system,Our major customers are Flextronics,HP over 7 years